All About The Wallace Insurance Agency

Indicators on The Wallace Insurance Agency You Should Know

Table of ContentsThe Wallace Insurance Agency Fundamentals ExplainedThe smart Trick of The Wallace Insurance Agency That Nobody is DiscussingIndicators on The Wallace Insurance Agency You Should KnowThe Of The Wallace Insurance AgencyNot known Facts About The Wallace Insurance Agency

Like term life insurance policy, whole life policies give a survivor benefit and other advantages that we'll enter later on. They have an essential difference: An entire life plan never ends. The main advantage of an entire life policy is that it develops cash value. A section of each premium settlement you make is put away in a various account that can be invested or accessed via a lending.The difference is that it provides the plan owner a lot a lot more adaptability in regards to their premiums and cash value. Whereas a term or whole life plan secure your rate, a global plan allows you to pay what you have the ability to or intend to with each costs. It likewise enables you to change your survivor benefit throughout the plan, which can't be made with various other kinds of life insurance policy.

If you have dependents, such as youngsters, a spouse, or moms and dads you're taking care of and lack significant riches it might remain in your ideal passion to acquire a plan also if you are relatively young. https://yoomark.com/content/most-trusted-insurance-meridian-wallace-insurance-agency-wallace-insurance-agency. Ought to anything happen to you, you have the tranquility of mind to understand that you'll leave your liked ones with the financial means to settle any kind of remaining expenditures, cover the prices of a funeral service, and have some cash left over for the future

See This Report about The Wallace Insurance Agency

Riders are optional changes that you can make to your policy to boost your insurance coverage and fit your needs. Common cyclists include: Unintended fatality and dismemberment - Liability insurance. This biker prolongs your insurance coverage and can attend to your family in case of a mishap that results in a handicap or death (i

Long-lasting treatment. If a plan proprietor requires funds to cover long-lasting care costs, this rider, when triggered, will certainly offer monthly repayments to cover those costs. Costs waiver. This rider can waive costs afterwards occasion so coverage is not shed if the policy owner can not pay the monthly prices of their plan.

Auto insurance policy spends for covered losses after a crash or incident, protecting against possible economic loss. Depending on your protection, a policy can safeguard you and your guests. A lot of states need chauffeurs to have automobile insurance policy coverage.

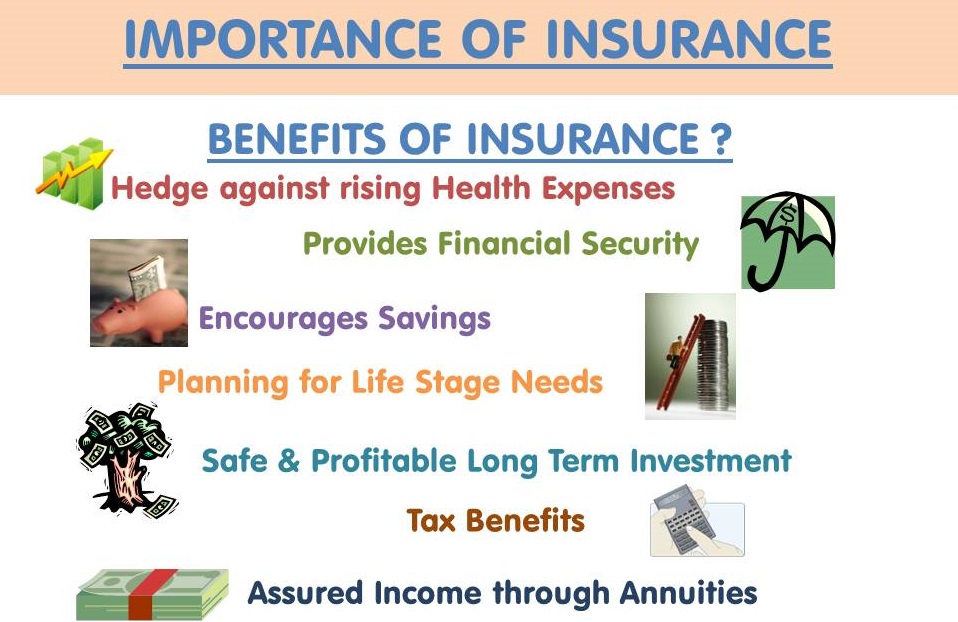

There are useful link numerous kinds of insurance coverage items like life insurance policy strategies, term insurance policy, wellness insurance policy, home insurance and even more. The core of any type of insurance strategy is to supply you with protection (Auto insurance).

The Ultimate Guide To The Wallace Insurance Agency

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)

Together with the life cover, they likewise supply maturity advantage, resulting in a fantastic savings corpus for the future. A prized belongings like your car or bike also requires defense in the type of automobile insurance policy in order to safeguard you from expense expenditures towards it repairs or uneventful loss.

But, what will occur, if you suddenly have to encounter completion of your life? Will your family members be able to satisfy their future needs without you? This is where a term insurance coverage strategy comes in useful. Secure the future of your family and get a term insurance coverage policy that will help your candidate or dependent receive a swelling amount or monthly payment to aid them take care of their economic necessities.

The Ultimate Guide To The Wallace Insurance Agency

Live a peaceful life and handle your dangers that you can face in daily life. Secure your life with insurance and make certain that you live your life tension-free. With increasing clinical expenses, medical insurance is required to hold. Secure you and your household with the coverage of your wellness insurance policy that will certainly offer for your health care expenses.

Life insurance policy plans and term insurance coverage policies are extremely important to safeguard the future of your household, in your absence (Liability insurance). You can have a full comfort, when you take care of the unpredictabilities of life with insurance. Insurance is a wonderful financial investment channel too. Life insurance plans helps with methodical financial savings by alloting funds in the kind of costs yearly.

Insurance coverage motivates financial savings by lowering your expenses in the lengthy run. You can avoid expense repayments for unfavorable occasions like medical disorders, loss of your bike, mishaps and even more. It is additionally an excellent tax obligation saving tool that aids you lower your tax obligation worry. Insurance policy attends to an efficient threat monitoring in life.